Government Schemes and Initiatives

Home Loan Fundamentals

Home Loan Fundamentals

What documents are needed for a home loan?

30/11/2024

What documents are needed for a home loan?

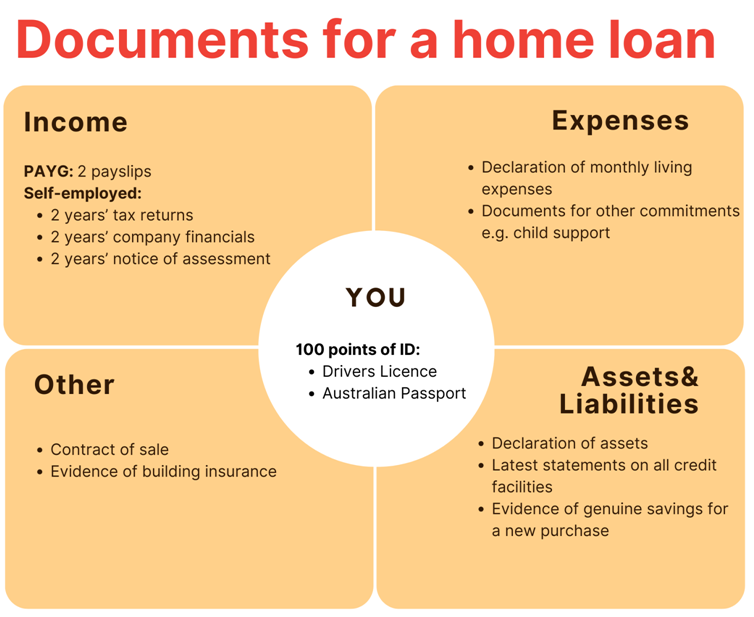

When you apply for a home loan, lenders require a variety of documents to determine whether lending to you is a sound decision. Much like you’d carefully consider lending a substantial amount to someone, lenders ask key questions to gauge your financial reliability:

- Is your identity verified?

- Do you have a strong history of repaying debts on time?

- What is your current income?

- What are your living expenses?

- What assets do you own?

- What existing liabilities do you have?

Simplified list of documents required for a home loan:

Identification: Drivers Licence and/or Passport is usually sufficient.

Income Documents:two most recent payslips for PAYG.

Liability Documents:Most recent statements or Internet printouts showing limits, instalments paid and outstanding balance and credit card limits

Contract of Sale:a fully executed contract of sale is needed unless you're seeking a pre-approval or refinancing.

Identification documents

At a minimum, you’ll need to provide two forms of identification – one from Category One and another from Category Two. If applicable, you’ll also need to include a change of name or marriage certificate.

However, many lenders may request additional identification, often following the ‘100 points of ID’ system. Generally, you’ll need either two photo IDs from Category One or one from Category One along with two from Category Two.

Identification verification can usually be completed through an in-person meeting with your broker, a video call, or by submitting JP-certified copies. Increasingly, lenders are adopting the NextGenID service, allowing brokers to verify clients’ IDs digitally.

Category One

Australian passport

(if expired - still acceptable but no more than two years

past their expiry date)

International passport

(if expired - still acceptable but no more than two years past their expiry date)

Driver Licence (must be current)

Category Two

Medicare card

Official State Photo ID (must be current)

Australian birth certificate, birth extract or citizenship certificate

Foreign birth certificate or citizenship certificate

Income documents

When applying for a home loan, you’ll need to provide income documents that demonstrate your financial ability to repay the loan. The specific documents required may vary based on your employment status and the lender, but generally, these include:

Income documents required for a home loan:

PAYG Permanent:

2 latest payslips showing YTD income.

PAYG Casual:

2 latest payslips + latest PAYG Summary or 6 months' bank statements.

Commission:

2 latest payslips + latest PAYG Summary.

Bonuses:

Last 2 years' tax returns.

Rental Income:

Latest rental statement, current lease agreement or transation statements.

Centrelink:

Latest Centrelink statement or transaction statements.

Dividends/investments:

Last 2 years' tax returns.

Self-employed full doc:

Latest 2 years' financials, ITRS, NOAs, CTRs, P&Ls, Balance sheets etc.

Self-employed low doc:

Latest 2 BAS, Accountant's Letter or 6 months' bank statements.

Liability documents

Lenders will assess your current liabilities to determine your capacity to manage additional debt. The typical liability documents you’ll need to provide include:

Liability documents required for a home loan:

- Credit card: most recent statements.

- Personal loan: most recent statements and other details.

- Car loan or lease agreements: statements or contracts.

- Home loan not being refinanced: most recent statements or internet printouts.

- Home loan being refinanced: most recent statement for the last 6 months.

- Buy Now, Pay Later (BNPL) accounts: most recent statements.

Contract of sale

If you’re applying for a home loan to purchase a property, the bank will always require a signed and dated Contract of Sale. This contract’s details are typically used for valuation purposes, though this isn’t always the case. If you’re refinancing, you’ll need to provide your latest Council Rates Notice to confirm your homeownership. For pre-approval applications, the Contract of Sale isn’t required upfront, but you’ll need to submit it once you’ve found a property and are ready for formal approval.

Ready to begin your home loan journey?

Navigating the home loan process can be overwhelming, but you don’t have to do it alone. If you have any questions or are ready to get started, reach out to us today. At North Rocks Mortgage Solutions, we’re here to guide you every step of the way, ensuring you have the support and expertise needed to secure the right loan for your needs. You can reach

me, Cordelia, directly at cordelia@northrocksmortgage.com.au or call 0433 035 911.

me, Cordelia, directly at cordelia@northrocksmortgage.com.au or call 0433 035 911.