Government Schemes and Initiatives

Home Loan Fundamentals

Home Loan Fundamentals

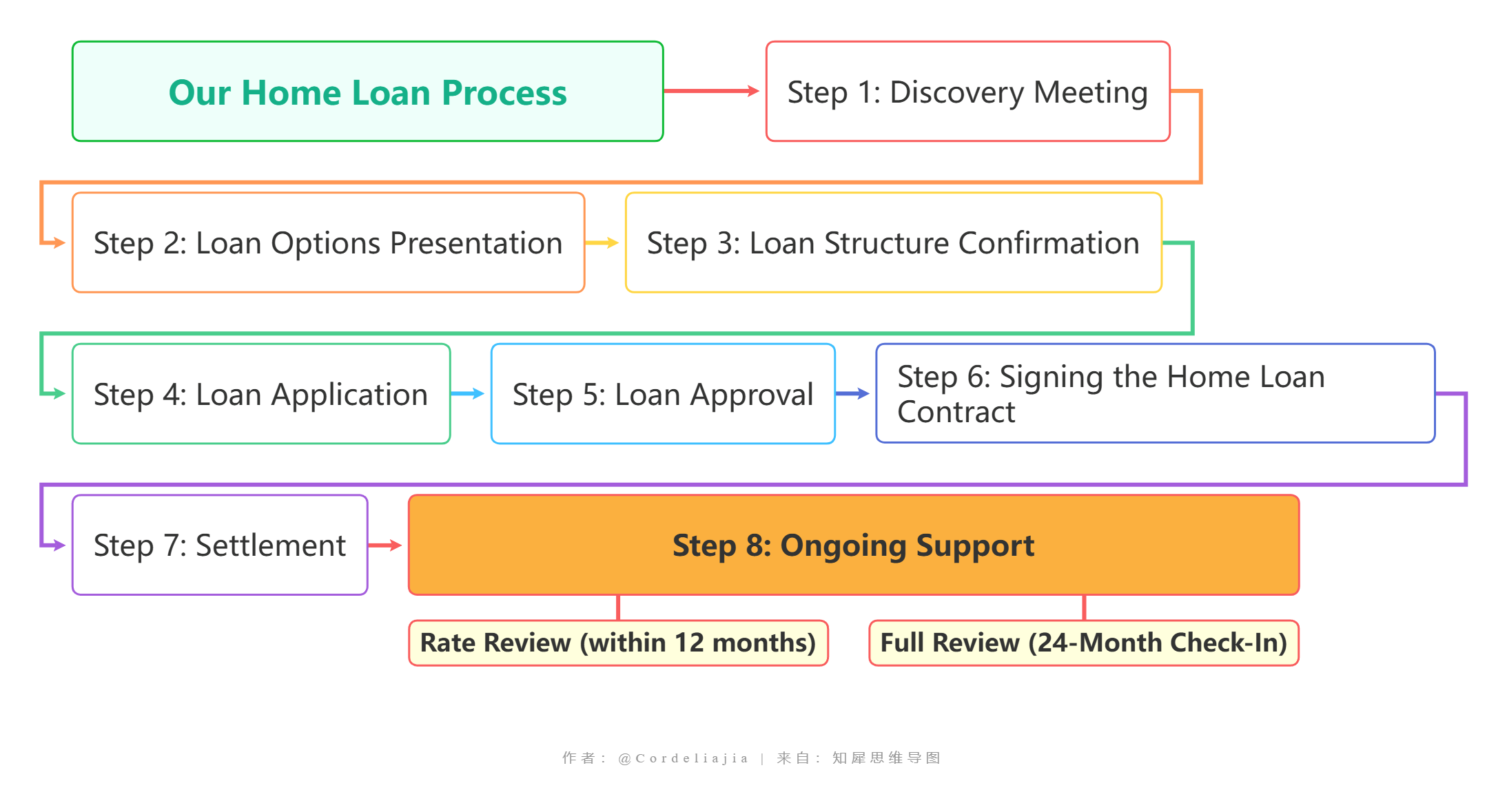

Our Home Loan Process

07/01/2025

Navigating the home loan process can be confusing, especially for first-time buyers. At North Rocks Mortgage Solutions, we’ve simplified the steps to guide you through with ease. Here’s a breakdown of our process:

Step 1: Discovery Meeting

The first step is a discovery meeting, where we get to know each other. We’ll discuss your long-term and short-term goals, objectives, and how we might help you achieve them. This meeting allows you to understand how we operate, and it helps us determine whether we are a good fit for each other.

Outcome: If it’s not a fit, we’ll part ways on good terms. If we are a fit, we’ll move on to the fact-finding process, where we’ll gather key financial details to begin crafting strategies and finding loan options aligned with your goals.

Step 2: Loan Options Presentation

Once we have all your details from the fact-finding process, we’ll work in the background to develop suitable strategies and loan options. Then, we’ll schedule a second meeting to present our recommendations, covering:

- Strategies and loan options

- The recommended lender

- Loan features and structure, such as offest accounts, split loans, or rate locks

Step 3: Loan Structure Confirmation

After presenting the options, we’ll confirm the loan product and structure with you via email. Once you agree to move forward, our team will collect any additional documents the lender requires (e.g. bank statements, credit history).

Step 4: Loan Application

Once all documents are ready, we’ll prepare the application forms and our Statement of Credit Advice (SOCA) , which outlines fees, interest rates, and repayment schedules. After you sign these, we’ll submit the loan to the lender on your behalf.

Step 5: Loan Approval

For new purchases, we generally recommend obtaining a fully assessed preapproval before you start looking for a property. A fully assessed pre-approval gives you confidence in your property search, as the lender’s credit department reviews your financial documents as if you’re applying for a full approval. This provides an indication of how much you can borrow.

Once you find your property and provide the contract of sale to the lender, the lender will finalise their assessment, including conducting a property valuation.

Once everything checks out, you’ll receive formal approval, confirming the loan. At this stage, you’re ready to proceed with signing the home loan contract.

For refinance, you will receive full approval if you meet the lender’s lending criteria.

Step 6: Signing the Home Loan Contract

Once approved, you’ll receive your home loan contract. This will include all the loan details. You’ll need to sign and return it along with any other required documents (e.g. insurance certificates). Our team will guide you through this process to ensure everything is completed correctly.

Step 7: Settlement

For New Purchases

Once the lender has everything they need, they will notify your solicitor that they are ready for settlement. On settlement day, the lender will transfer the funds, and the property title will be transferred to you. Once this is finalised, you can collect the keys and move into your new home.

For Refinances

Your current loan will be settled, and your new loan will take effect. This usually involves paying off your previous lender, transferring the mortgage, and setting up your new loan terms.

Step 8: Ongoing Support

Our support doesn’t stop at settlement.

Rate Review

Within 12 months after settlement—or before the end of a fixed-term loan—we proactively review your interest rate to ensure it remains competitive. If you feel that your rate doesn’t match market conditions, you can reach out to us for an earlier rate review. We’ll analyse current rates, lending products, and your specific loan terms to find the best possible deal for your circumstances.

Full Review (24-Month Check-In)

At 24 months post-settlement, we perform a comprehensive review of your financial situation as it relates to your home loan and overall goals. This “Full Review” goes beyond checking the interest rate; it considers changes in your financial status, objectives, and market conditions.

- Financial Changes: We’ll assess any significant life or financial changes that might affect your mortgage needs, such as changes in income, employment, or family structure.

- Home Equity & Loan Structuring: This is an opportunity to leverage any increase in property value by tapping into home equity. We can explore restructuring options, such as refinancing to access funds for renovations or investing in other properties.

- Product Suitability: We’ll review whether your current loan product is still the best match for you. If better options have emerged in the market that align with your financial goals—whether they involve features like offset accounts, redraw facilities, or simply a lower rate—we’ll help you switch with minimal disruption.

Ready to start your home loan journey with confidence?

Contact us today to schedule your discovery meeting and take the first step toward securing the best possible mortgage for your needs!